PERSONAL FINANCE SPECIAL (BUDGET 2017-2018)

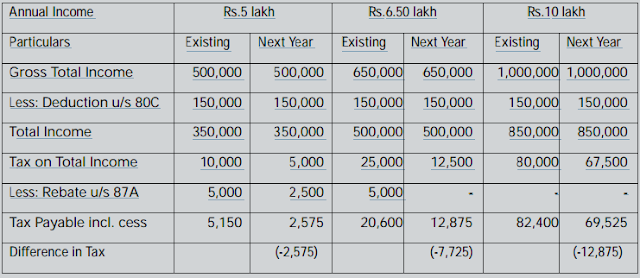

Hello Readers, Here, I able to collected short note about personal financial budget 2017-2018 year. 1) Income Tax rate cut to 5 % in the income slab between Rs 2.5 lakh and Rs 5 lakh from 10% Effect on Tax Payer : Positive. This will reduce the tax liability of all tax payers across slabs. The percentage reduction of tax liability will be greater for tax payers in the lower slabs. 2) Rebate under Section 87A reduced from Rs.5,000 to Rs.2,500 and the applicable limit has been reduced from taxable income of Rs.5 lakh to Rs.3.50 lakh. Please refer below illustration to understand the effect of both the above changes: 3) 10% surcharge on individual income above Rs 50 lakh and upto Rs 1 crore to make up for Rs 15,000 cr loss of due to cut in personal I-T rate. The existing surcharge of 15% for total income above Rs 1 crore remains unchanged. Effect on Tax Payer :Negative. This will increase the tax liability of tax payers with total income more than Rs.50 lakh and upto